Stock option qualifying disposition

Employee Stock Purchase Plan ESPP.

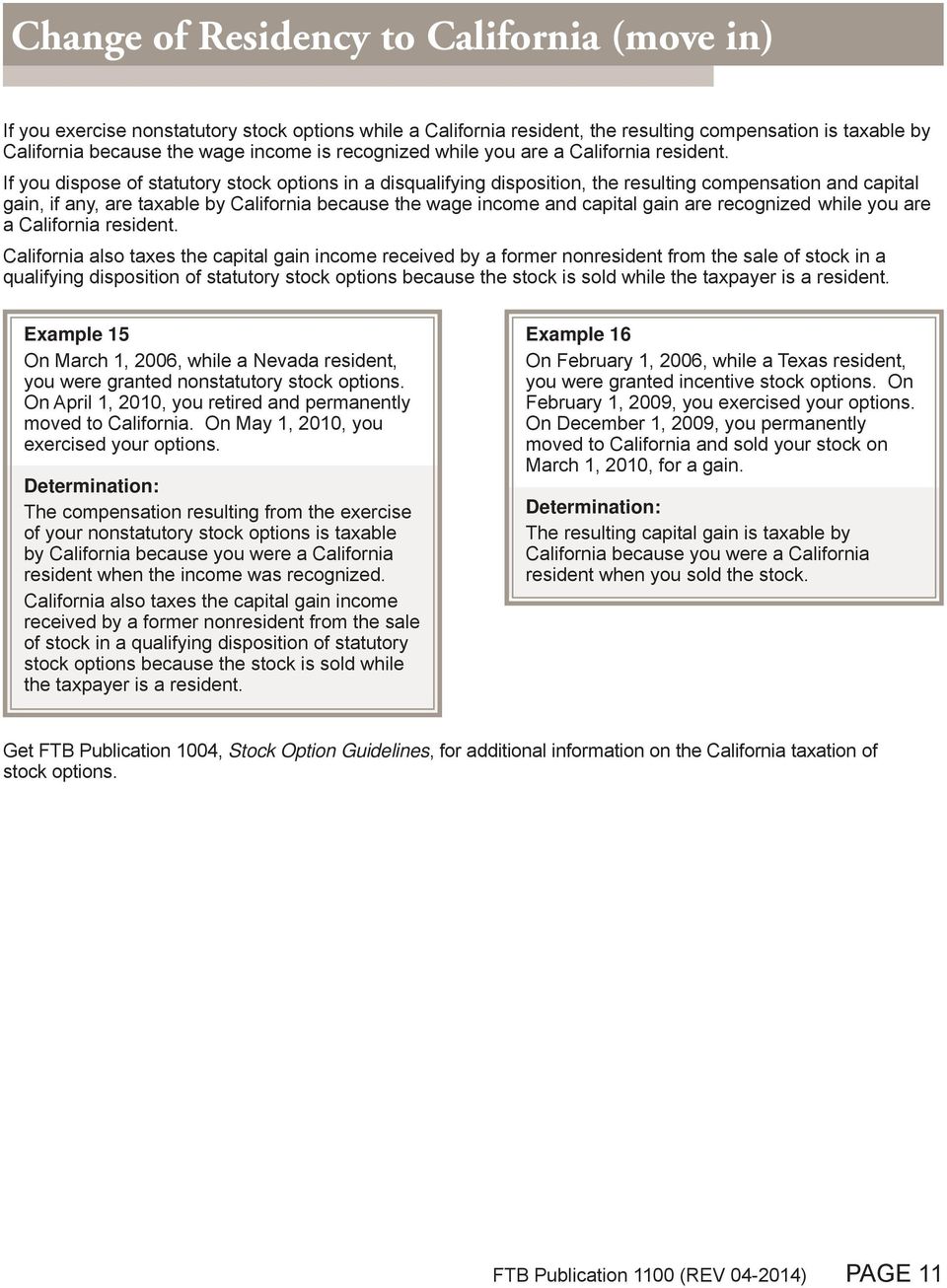

Outlined below is a series of steps you will need to review before entering your stock transaction information into the TaxAct program. A qualifying disposition means both of the following are true regarding your sale:. The compensation income for a qualifying disposition is the lesser of two amounts.

Stocks (Options, Splits, Traders)

The first amount is the discount allowed on the purchase of the stock. This would be the difference between the fair market value FMV of the stock on the grant date and the actual amount you paid for the shares.

The second amount is the difference between the FMV of the stock when you disposed of it and the actual amount you paid for the shares. For a disqualifying disposition, the compensation income is calculated as the value of those shares on the date of purchase minus the amount you paid for them.

Qualifying Disposition

Generally, this would be the discount you received on the stock purchase. If there are any capital gains to report or if you received a Form B, you would need to complete Federal Form B in the program to report the information on Form and Schedule D. The information would be entered in the Investment Income section of TaxAct as follows:. Compensation Income not Reported on Form W TaxAct allows you to add the ordinary income from an ESPP sale to your wages on Form , Line 7, if this amount has NOT been included in your wages by your employer.

Menu TaxAct Sign In Search. We're ready to help. Ask, or enter a search term below. Stocks purchased through an employee stock purchase plan are purchased at a discount.

This discount is outlined in the terms of the purchase plan and will differ between companies. The discount the employee receives on the stock purchase is considered compensation income and reported as ordinary income.

This amount will depend on whether you have a qualifying disposition or a disqualifying disposition. See the information below for more information.

The compensation income should have been included in your Form W-2 you received from your employer maintaining the plan. You may need to contact your employer or plan administrator to determine if any amount was included on your Form W-2 as wages.

You should have also received literature from them on the tax treatment of the plan you are under and how it is reported.

Employee Stock Purchase Plans - TurboTax Tax Tips & Videos

If the compensation income was reported on Form W-2, then you will simply enter your Form W-2 as normal. If any compensation income was NOT included on Form W-2, see the additional information below. You will then report the sale of the stock on a Form B. You will enter the sales proceeds as reported on the Form B you received. If basis was NOT reported on the Form B you received, then you will enter the basis as calculated in step 4 above. If the basis was reported on the Form B you received then you will need to compare the amount reported with the amount calculated in step 4 above.

You will need to enter the basis as it was reported on the Form B you received. If this amount does not equal the basis calculated in step 4 then you will enter an adjustment code B and adjustment amount to account for an incorrectly reported basis.

For more information about entering an adjustment code and adjustment amount see the IRS Form Instructions. Disqualifying Disposition A qualifying disposition means both of the following are true regarding your sale: It is more than a year after the purchase of the stock. It is more than two years after the grant date. This would be the first day of the offering period, sometimes referred to as the enrollment date The compensation income for a qualifying disposition is the lesser of two amounts.

Reporting in TaxAct If there are any capital gains to report or if you received a Form B, you would need to complete Federal Form B in the program to report the information on Form and Schedule D.

The information would be entered in the Investment Income section of TaxAct as follows: Was this helpful to you? Audit Assistant Get the information you need. Help and Support Check E-file Status Service and Support About Your Taxes Health Care and Taxes TaxAct Blog TaxAct Apps Get Started Compare Online Tax Products Compare Desktop Tax Products Start or Access Prior Year Tax Products Estates and Trusts Small Business Taxes Professional Products About Why Choose TaxAct?

Product Guarantees Press Center Refer a Friend Careers.

Get Started Compare Online Tax Products Compare Desktop Tax Products Start or Access Prior Year Tax Products Estates and Trusts Small Business Taxes Professional Products. Help and Support Check E-file Status Service and Support About Your Taxes Health Care and Taxes TaxAct Blog TaxAct Apps. About Why Choose TaxAct? Norton Secured TRUSTe Certified Privacy TrustWave Trusted Commerce Authorized E-file Provider.

Legal Notice Site Map Privacy Policy Security Affiliates. Visit TaxAct on Facebook Visit TaxAct on Twitter Visit TaxAct on LinkedIn Visit TaxAct on Google Plus Visit TaxAct on YouTube Visit the TaxAct Blog.