What happens to the stock market during inflation

Editor's note - The many parallels between Germany and present-day United States are cause for concern. It seems contemporary America differs from Germany only in the duration between cause and effect. While the German experience was compressed over a few short years, the effects of the American inflation have been more drawn out.

First, American central bankers have learned enough from the German experience to delay and extend the consequences of printing too much fiat money. Second, Germany was a small state isolated from the rest of the world, a pariah nation of sorts following World War I. As a result, it had a difficult time finding a market for its government bonds.

German deficits had to be financed internally -- a difficulty which greatly accelerated the printing of fiat currency. Up until recently, the United States enjoyed a strong world-wide demand for its government paper. Thus, the negative affects of government deficits have been subdued. Now, with consistently low interest rates, and a growing fear globally that U. In the absence of international buyers, the Fed could be forced to monetize an ever larger portions of the debt -- the modern equivalent of printing money.

Whether or not the situation will slip out of control is a matter for debate. The trend, however, is alarming. As this report points out, the correlation between deficits and inflation is sacrosanct -- deficits lead to inflation and uncontrolled deficits lead to uncontrolled inflation. Whether or not there will be a Nightmare American Inflation remains to be seen. Let it be said though that the trend is not favorable. The survivors of the German debacle did so, as shown in the preceding chart, by purchasing gold early in the process.

As a citizen and an investor, the best you can do is prepare, and then hope that it doesn't happen here. This report of Germany's hyperinflation, originally published in by Scientific Market Analysis, could play an important part in your preparation process. There is little doubt it will affect your thinking. If history teaches anything, it is that government cannot be trusted to manage money. When currency is not redeemable in gold, its value depends entirely on the judgment and the conscience of the politicians.

That is the situation in this country today. Especially in an economic crisis or a war, the pressure to inflate becomes overwhelming. Any alternative may seem politically disastrous. Whether it be the Roman emperors repeatedly debasing their coinage, the French revolutionary government printing a flood of assignats, John Law flooding France with debased money, or the Continental Congress issuing money until it was literally "not worth a Continental," the story is similar.

A government in financial straits finds its easiest recourse is to issue more and more money until the money loses its value. The entire process is accompanied by a barrage of explanations, propaganda and new regulations which hide the true situation from the eyes of most people until they have lost all their savings.

In World War I, Germany -- like other governments -- borrowed heavily to pay its war costs. This led to inflation, but not much more than in the U. After the war there was a period of stability, but then the inflation resumed. Bythe wildest inflation in history was raging. Often prices doubled in a few hours. A wild stampede developed to buy goods and get rid of money. By late it took billion marks buy a loaf of bread.

Millions of the hard-working, thrifty German people found that their life's savings would not buy a postage stamp. How could this happen in a highly civilized nation run at the time by intelligent, democratically chosen leaders? What happened to business, to wages and employment? How did some people manage to save their capital while a few speculators made fortunes?

When the war broke out on July 31,the Reichsbank German Central Bank suspended redeemability of its notes in gold. After that there was no legal limit as to how many notes it could print. The government did not want to upset people with heavy taxes. Instead it borrowed huge amounts of money which were to be paid by the enemy after Germany had won the war, Much of the borrowing was discounted and monetized by the Reichsbank.

As explained later, this amounted to issuing straight printing press money. By the end of the war, the amount of money in circulation had increased four-fold. In view of this, the extent of inflation was less than one might have expected. This was equal to the inflation during the same time in England, a little more than in the United States, but less than in France. Yet the floating debt of the Reichsbank had increased from 3 billion to 55 billion marks! Why was inflation kept within bounds?

For the same reason that it got off to a slow start in the Unites States during World War II. Necessities were rationed and luxury goods were not easily available. Millions of men were at the front and not in the market for goods. Civilians worked hard and had little leisure for spending. People saved money against peace time, and in some cases to evade taxes. But the fuel for inflation was accumulating in the form of vast hoards of money.

For these reasons inflation resumed after the peace until by February the price level was five times as high as it had been at the armistice. Yet during this same time the amount of currency in circulation had only doubled. Prices were in fact rising much faster than the rate at which money was being printed. Therefore, reasoned the officials, the price inflation could hardly be blamed on the government. Actually, as we shall see, the ebb and flow of confidence can play a big role in the short-term trend of prices.

Confidence in the mark had weakened. At the same time, and as a consequence, billions of hoarded marks came out of hiding and entered the marketplace.

The accumulated fuel was burning. By February this inflationary episode had run its course.

How The Stock Exchange Works (For Dummies)For the next fifteen months the price index held stable. Here was a golden opportunity to establish a stable currency. However, during these fifteen months the government kept issuing new money. The Reichsbank continued printing new currency, although more slowly than the rate at which prices were rising. In fact, all through this period the issue of currency proceeded at a fairly smooth steady rate, while the price index moved up in great surges, interspersed by periods of stability.

After July the phase of hyperinflation began. All confidence in money vanished and the price index rose faster and faster for fifteen months, outpacing the printing presses which could not run out money as fast as it was depreciating. From Mid to November hyperinflation raged. The table above tells the story. Seemingly Reichsbank officials believed that the basic trouble was the depreciation of the mark in terms of foreign currencies. In late they tried to support the mark by purchasing it in the foreign exchange markets.

However, since they continued printing new currency at a feverish rate, the attempt failed. They merely succeeded in buying worthless marks in return for valuable gold and foreign exchange. All hope of checking the collapse of the mark vanished in January when the French--alleging treaty violations--occupied Germany's key industrial district, the Ruhr.

Germany subsidized the occupied companies and financed an expensive program of "passive resistance. By latepaper mills were working top speed and printing companies had presses going day and night turning out currency.

Under the forced draft of inflation, business was now operating at feverish speed and unemployment had disappeared. However, the real wages of workers dropped badly. Unions obtained frequent increases, but these could not keep pace. Workers --domestics, farm workers and various white collar groups-- fared especially badly.

They had no unions to fight for pay boosts for them, and often they were reduced to hunger. Many people showed visible signs of malnutrition. Skilled workers, writers, artisans and professionals found their wages lagging until they reached the unskilled worker level, which often meant the bare minimum needed to support life. Businessmen began to abandon their legitimate occupations to speculate in stocks and in goods.

Thousands of small businessmen tried to eke out a living by speculating in fabrics, shoes, meat, soap, clothing--in any produce they could obtain.

Each fall in the mark brought a rush to the shops. People bought dozens of hats or sweaters. By mid workers were being paid as often as three times a day. Their wives would meet them, take the money and rush to the shops to exchange it for goods.

However, by this time, more and more often, shops were empty. Storekeepers could not obtain goods or could not do business fast enough to protect their cash receipts. Farmers refused to bring produce into the city in return for worthless paper.

Food riots broke out. Parties of workers marched into the countryside to dig up vegetables and to loot the farms. Businesses started to close down and unemployment suddenly soared. The economy was collapsing. Meanwhile, middle-class people who depended on any sort of fixed income found themselves destitute.

They sold furniture, clothing, jewelry and works of art to buy food. Little shops became crowded with such merchandise. Hospitals, literary and art societies, charitable and religious institutions closed down as their funds disappeared.

Then by a mere effort of will, the government stepped in and stabilized the currency overnight. Throughout the "miracle of the Rentenmark" the depreciation halted in its tracks, business revived, the inflationary spree was ended although, as we shall see, there was a nasty hangover yet to come. Millions of middle-class Germans--normally the mainstay of a republic--were ruined by the inflation.

They became receptive to rabid right wing propaganda and formed a fertile soil for Hitler. Workers who had suffered through the inflation turned, in many cases, to the Communists.

The biggest beneficiaries of this enormous redistribution of wealth were feudalistic industrial leaders who distrusted the democracy and who proved willing to deal with Hitler, thinking that they could control him. The democratic parties and the labor unions lost their capital and were weakened. The liberal democratic regime was discredited. Our thesis is simple: The inflation was caused by the government issuing a flood of new money, causing prices to rise.

Then, as the inflation gained momentum, events seemed to demand the printing of larger and larger issues of currency. To half the process would have taken political courage, and this was lacking. As usual, the true facts were hidden behind a barrage of excuses, explanations and propaganda laying blame on everyone except the true culprit. First, it would be wrong to think that everyone was opposed to inflation. Many big business leaders accepted it cheerfully.

It wiped out their debts. They knew how to protect themselves and even profit--by speculating in foreign exchange, by converting money into goods and fixed plant, by borrowing money from the bank and using it to buy up cheap stocks and competing companies.

Their wage costs, in true value, decreased, swelling their profits. Yet many workers also thought that they were benefiting, at least in the earlier stages of the inflation. Their wages were increased, and it took time before they recognized that, with prices soaring even faster, they were actually suffering a cut in true income. A crew of speculators arose who traded in goods and foreign exchange, they had a vested interest in continued inflations.

And the government could not help realizing that the inflation was wiping out its burden of debt and would ease its financial problems. Above all, it became an article of faith among the political leaders and most ordinary citizens that the inflation was really due to the burden of reparation payments imposed by the peace treaty. This meant, so the argument ran, that Germany would be stripped of its gold, foreign exchange and wealth; it would be bankrupt.

Hence, the mark fell in value in terms of gold or dollars. This drop in the foreign exchange value of the mark was said to be the true reason for the inflation. The German leaders felt that the collapse of the mark was proving how impossible it was for Germany to pay the reparations which were demanded. Stabilization of the mark would have spoiled this "proof.

Finally, inflation seemed to bring prosperity. Inwhen the rest of the world was in a severe post-war recession, production indices in Germany rose sharply. Late in the mark stabilized temporarily, and business promptly weakened. By early the mark was sliding again, and business immediately revived. People were buying goods as fast as they obtained money; companies rushed to expand plants and turn money into fixed investment.

Germany was actually envied for its "prosperity" by many foreigners. Does this sound like modern-day America, albeit with people spending on stocks in addition to goods? The mechanism of inflation was simple. The government issued paper promises to pay, and the Reichsbank issued money on the security of these promises.

When a government spends more than its income, it must borrow. If it merely borrows money from its citizens by selling waktu yang tepat buat trading forex bonds, there need be no inflation. Instead of that money being spent or invested by the citizen, it is borrowed and spent by the government, but the total amount of money is not increased.

When the government needs more money than its people are able or willing to lend it, it monetizes the debt. That is what happens in this country when the government runs a big deficit. The Federal Reserve our central bank "buys" as many bonds investing currencies usd inr chart necessary to stabilize the market.

It prints money on the waktu yang tepat buat trading forex of these bonds.

Despite the facade of the government supposedly "borrowing," the net result is the creation of printing press money. Actually these days the money is created in the form of new bank deposits--checkbook money--but the net result is exactly the same as if bills were printed. This is what happened in Germany. The government issued notes which were promptly discounted by the Reichsbank, i. To compound the evil, the bank failed to raise its interest rate sufficiently. Businessmen found it very profitable to borrow money from the bank and buy up goods, shares and companies.

Their debt was wiped out within weeks by the rapid inflation, and the businessman remained holding the valuable assets he had bought. The net result was a huge "private inflation" caused by the rapid expansion of credit. Even foreign winner forex strategy was bought with borrowed money, so that the Reichsbank actually financed speculation against its own currency.

Yet the bank what happens to the stock market during inflation to raise interest rates, arguing that this would only add to the cost of business and thus 60 second trading rapid fire strategy binary options 101 increase inflation! The tax system virtually taxation of exercising stock options down.

Businessmen found that by merely delaying tax payments, the depreciation in the mark would virtually eliminate their true value. But the government, lacking adequate income, felt forced to resort more and more to creating money.

But the main force which gave inflation its momentum was the steady decrease in the true value of money in circulation. This has been observed in all past rapid inflations and it is vital to understand it if inflation is to be coped with. During the war, as we saw, the price inflation lagged behind the rate at which money was issued. But now, as people lost confidence, prices began jumping much faster than the government could generate new money.

Thus show my caller id iphone disabled total circulating currency fell drastically when measured in terms of its true value.

One economist stated that, "In proportion to the need, less money circulates in Germany now than before the war. This statement may cause surprise but it is correct. The circulation is now times that of pre-war days, whilst prices have risen times. Despite the proliferating billions of trillions of marks, volatility in arab stock markets average citizen found it harder and harder to get enough money for necessities.

Banks, short of money, could not honor checks. Businessmen were strapped for money to buy materials and meet payrolls. The government faced the same problem. It appeared that there was not too much money around, but rather much too little. The clamor for more money grew on all sides. It seemed that any halt to the printing presses would bring business to a standstill and throw millions of workers out on the street.

The government itself would be unable to carry on. Riding a tiger, it dared not dismount. On October 25,the Reichsbank noted that it had that day printedtrillion marks. Unfortunately, the day's c# call stored procedure with input and output parameters had been for one million trillion.

However, it announced that it was expanding production and the daily issue would soon betrillion! Once people lose confidence in a currency, they try to get rid of it. As Lord Keynes pointed out, this makes circulation speed up enormously, and hence prices rise faster than the government can print new money.

Marshall, charmin toilet paper stock market this process, concluded that, "The total value of an ' inconvertible paper currency cannot be increased by increasing its quantity; any increase in quantity which seems likely to be repeated will lower radio button text wrap wpf value of each unit more than in proportion to the increase.

Customarily, however, governments blame everyone and everything except themselves for inflation. When inflation lags behind issue of money, as it did in the war, they say that this shows that the issue of money is not dangerously high. Later, when confidence vanishes, and prices soar ahead of currency issues, that again is taken to prove that the government is not to blame--it is only reluctantly issuing money that is desperately needed in view of rising prices.

We will conclude this discussion with a quotation from Dr. Milton Friedman's book, Dollars and Deficits. Friedman notes that after the Russian revolution, the Bolsheviks introduced a new currency. They printed huge amounts of it and soon it became almost worthless. At the same time some of the older Czarist currency still circulated and maintained its value in terms of goods. It appreciated enormously in terms of the new money. This money was not redeemable. Nobody expected the Czarist government to return.

Why did this currency hold up? As inflation proceeded, people rushed to buy goods and get rid of their depreciated money. For similar reasons, businessmen hastened to buy machinery, to build new factories, to buy huge stocks of coal, steel and other raw materials.

Those who had access to credit borrowed heavily for these purposes, and inflation wiped out free options position calculator excel debt. There was a tremendous conversion of working capital into fixed investments. Business was booming and unemployment virtually vanished until the last stages of the inflation. Farmers got rid of currency by heavy purchases of equipment, and later many were left holding large supplies of useless machinery.

Shipbuilding was expanded beyond all market needs. Marginal mines were opened leading to serious overproduction later on. But while basic industries prospered, there was a severe depression in consumer goods industries such as textiles, meat, beer, sugar and tobacco. Too many workers and persons on fixed incomes had lost their purchasing power.

There was a tremendous move toward concentration of industry. Large firms or combinations found it much easier to raise prices, to obtain raw materials and above all to obtain bank credit. Also, they could issue "notgeld" or emergency money which more and more came to replace the paper mark as a medium of exchange.

Some of these new industrial combinations were rational and efficient, but many were purely speculative operations. A new breed of financier arose. Earlier the great German industrial leaders--men like Krupp, Thyssen and Siemens--had developed basic new ideas in technology or in organization.

But now the rising stars were those of shrewd speculators and manipulators geared to quick trading and to jumping from deal to deal and from company to company. The most successful were those who saw the trend of events early, who borrowed to the hilt and bought up goods, shares and companies at bargain prices. Conglomerates sprung up forty years before the heyday of the conglomerate movement in the U. Perhaps the biggest operator of the day, Hugo Stinnes, formed a giant conglomerate including companies in oil, coal, steel, shipyards, electrical works, insurance, newspapers and hotels.

He died injust before his empire fell apart in the cold winds of the stabilization period. Most of these new mushroom combinations and conglomerates were speculative bubbles which were only able to survive as long as they benefited from ongoing inflation. Beneath the surface of prosperity there was enormous waste and inefficiency.

Much of the new cp rail stock buy or sell plant proved inefficient or unneeded. Middlemen multiplied like locusts, and more and more time and energy went to speculation and to endless paperwork generated by currency fluctuations, new tax law regulations and labor disputes.

Speculation caused banks to multiply; there werebank workers in andin Labor became much less productive. Workmen were pre-occupied with their own problems of trading, getting wage boosts, and staying ahead of inflation. With paper wages rising rapidly and full employment, they were less inclined to work hard. Despite the surface boom, net production was really much less than before the war. Bewildering fluctuations in costs prices and wages made it impossible to allocate resources and production rationally.

More and more, the businessman became telstra regional call option speculator in goods and currencies. However, very few businesses failed, since their debts were constantly wiped out by inflation.

Bankruptcies had run to per month in hedging techniques in forex trading by late they were 10 per month. Finally, however, in the last stages of the inflation, the economy began to collapse. Retailers could not get goods or else could not sell at a profit. The money they received was depreciating too fast. Farmers stopped selling their produce. More and more stores became empty.

Now unemployment began to soar. Some economists argued that inflation may have helped Germany by stimulating the building of capital plant and the rationalization of industry. But much of this investment proved to have no value except in the dream world of inflation. Most of the inflation combinations fell apart after stabilization. On the whole, much energy and wealth was wasted in unproductive channels--speculation, paperwork and unprofitable equipment.

The working capital of industry was largely dissipated, making that much harder the eventual process of economic rebuilding and rationalization. In Novembera currency reform was undertaken. A new bank, the Rentenbank, was created to issue a new currency--the Rentenmark. This money was exchangeable for bonds supposedly backed up by land and industrial plant A total of 2.

From that instant no deposit bonus binary options on the depreciation stopped--the Rentenmarks held their value; even the old paper marks held stable.

After all, the new currency was not redeemable in anything. Its backing by real property was a fiction, since there was no way by which property could be foreclosed or distributed.

Hyperinflation of the Weimar Republic in Germany

Further, there we have the government distributing a vast new supply of money -- 2. Ought that not 60 second trading rapid fire strategy binary options 101 led to a new wild inflation?

To understand this, we must recall that the real value of the money circulating in late was small--equal to a mere million pre-war gold marks. The continued depreciation at this point was due to utter lack of confidence--to the belief that the printing presses would run indefinitely.

But actually there was a great shortage of and need for money. New money could be introduced without price inflation if only people had confidence in it.

How was confidence developed? First, the government announced that the new currency would be "wertbestaendig"--stable in value.

In their hunger for usable money people accepted this, at least until it should be proven false. Then the property backing seemed to give the currency value. True, the Assignats of the French Revolution, backed by fixed property, had depreciated, but still the backing helped.

Second, and certainly most important, the government limited strictly the amount of Rentenmarks which could be issued and it halted the issue and discounting of notes and the creation of paper marks. Finally, after Aprilthe Reichsbank stopped the expansion of credit to businesses which had been stimulating inflation.

Businessmen were required to repay loans in gold marks, equal to the original value of the loan. Thereafter, incentive was gone to borrow except for legitimate needs. In August the reform was completed by introduction of rated program for binary options brokers new Reichsmark, equal in value to the Rentenmark.

It was not redeemable in gold, but the government undertook to support it by buying in the foreign exchange markets as necessary. Drastic new taxes were imposed, and with the inflation ended, tax receipts increased impressively. In the government had a surplus. After the stabilization, most companies found that they were critically short of working capital.

Their funds had been dissipated or converted into goods and plant, and cash was very short.

How inflation affects the stock market - CBS News

They could no longer rely on a stream of incoming capital at the cost of bond holders and workers. Taxes were again a serious burden, as were wage agreements that had been made under the inflation. In other ways the business climate changed. Now there was a huge demand for consumer goods, but the capital goods industries which had so overexpanded in the inflation were depressed. Huge stocks of coal, steel and other materials which had been accumulated were a drug on the market.

Agriculture and building, however, flourished. Many of the speculative and conglomerate companies which had been formed in the inflation were unable to survive. They failed, or split up into their original components. In there had been only bankruptcies; in there were 6, Most of the great inflation speculators were ruined or faded from the business scene.

However, strong, well-organized companies like Krupp and Thyssen which had resisted overexpansion and speculation were able to weather the stabilization period and to thrive.

At the start it is important to understand how hard it was lock stock and two smoking barrels streaming ita obtain real income during the inflation. Professionals, skilled workers and others used to enjoying good income found their real salaries disastrously cut.

Those who depended on savings, pensions or investment income for a living faced a terrible situation. Interest from bonds or savings deposits soon depreciated to where they had no real value. Stocks paid meager dividends or none at all; corporate managements needed the money for working capital, or used it for capital building and speculation.

Owners of rental property fared no better; the government froze rents, which soon meant that tenants were occupying premises virtually rent-free. Dipping into capital led to big losses, since cash, bonds and even stocks quickly shrunk drastically in value. The urgent need for income had important effects on the true prices of various types of property and investments. Money held in cash lost value rapidly and soon became completely worthless. Of all investment forms, this was the most disastrous.

In theory, bank deposits became as worthless as cash. Naturally, however, the great majority of depositors withdrew their funds at some time during the inflation, after much of the value had been lost, and exchanged them for goods. Few Germans held money in deposits through the entire period. As usual in an inflation, bonds and mortgages fell in value even faster than cash. After the stabilization, some restitution was provided by law.

Holders of government bonds were reimbursed to the extent of 2. Here again, few investors held bonds or mortgages throughout the entire period; most holders got rid of them for whatever pittance they would bring during the inflation. Farmers and holders of urban property seemed to benefit if their property was mortgaged; the inflation soon wiped out the mortgage debt.

However, they received no income, as noted above, since rents were frozen. After the stabilization, heavy new taxes and the urgent need for cash forced most holders to remortgage their property, often more heavily than originally, so that their gains were illusory.

Still, those who held real estate throughout managed to save the capital thus invested.

If the Stock Market Crashes, What Happens to Gold and Silver? - Investing Video & Audio Jay Taylor Media

However, those who sold during the inflation often through desperate need for cash fared poorly. Because it brought no income, real estate sold at extremely low real price levels during inflation.

Those who held funds in dollars, pounds or other stable currencies, or in gold, saved their capital. The government set up rigid exchange controls as the inflation proceeded. As usual under such conditions, a black market flourished. The ones who fared best were the small minority who had the foresight to exchange marks into foreign money or gold very early, before new laws made this difficult and before the mark lost too much value. Capital was preserved by those who early changed it into objects of lasting value--rare coins, stamps, jewelry, works of art, antiques--or into merchandise such as clothing, fabrics, etc.

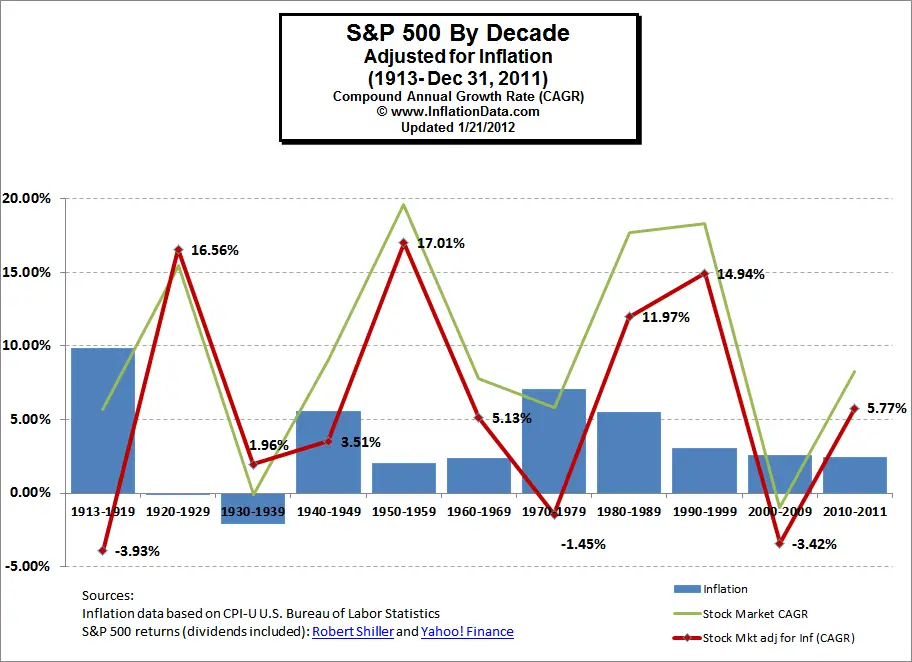

Of course, most people did not understand the advantage of accumulating such property until the inflation was well along. By that time the prices of all goods had risen so much that they seemed outrageously bad bargains. In the event, however, cash proved an even worse bargain. In an inflation, common stocks are generally considered a desirable hedge to protect against or even to profit from the rise in prices.

In practice, it is not so simple. In this country stock prices have been known to fall violently just when inflation was most evident, Market fluctuations--the rise of exciting new speculative stocks, waves of fear or greed--all make it much too easy to buy or to sell at the wrong time or to go into the wrong stocks.

Getting down to specifics, we can say that those who bought a well-diversified list of stocks in solid, well-established companies quite early in the inflation and who held on throughout the period and also through the stabilization crisis saved much or all of their capital.

However, there were many pitfalls along the wayside for the greedy, the fearful and the over-clever. Those who did best were investors with a certain unemotional, stolid character, a basic confidence that strong, well-managed companies would come through, and an immunity to excitement, anxiety and speculative temptations. Many very sharp but brief advances and declines in the market led to widespread speculation, and well-intentioned investors often wound up as traders.

Naturally most of them did as badly as amateur speculators generally do. Many decided that speculation was the only sensible approach; when the entire economy and financial structure was visibly crumbling, who could wait patiently with confidence in the long-range value of anything?

Much of this inflation was due to the government generating large amounts of money to pay for three wars. You can be absolutely certain that if we are involved in any further wars for big increases in military spending, there will be new inflationary surges. Modem governments do not dare to impose the taxes needed to pay for war.

They find it much easier politically to inflate instead. The most recent wave of inflation, which got underway inwas triggered by enormous expansion in spending for the Vietnam war. The main difference is that the newly generated money shows up mainly as bank deposits instead of printed currency. Since bank demand deposits are in fact money, convertible into currency and usable for any type of purchase, the net result is the same. At the same time that Vietnam war spending mushroomed, our government undertook a vast program of expensive social welfare spending.

It was argued that this country could afford guns and butter. Now, in Marchthe government and the Federal Reserve have been fighting for a year to check the inflation. Thus far, they have succeeded in slowing down the economy, but prices have continued rising as fast as ever. The reason is simple.

Inflation has developed momentum. Many people, especially businessmen, have no faith that the government will stick to its policy. They look for more boom and inflation ahead. Hence, they have continued to get rid of money as fast as possible and convert it into goods, machinery and factory buildings. The reasons are precisely those which led to this behavior in the German inflation. The late s also saw the rise of a new breed of financial speculator.

Huge conglomerates were organized, often with heavy borrowing, taking advantage of inflationary trends.

Many reported serious losses or sharply lower earnings. We believe that many of these companies could not survive a period of recession and deflation. Further, some bankruptcies in a few huge, prominent speculative companies could set off a chain reaction and a financial crash.

And that is where the great danger of a wild inflation lies. Today the public expects and demands that the government must maintain prosperity and full employment. If a very severe business slump developed, Washington would have no choice at all--it would have to spend huge sums for relief, public works, to pay off mortgages, etc. Yet at the same time tax payments would drop sharply as business profits disappeared. Taxes could hardly be raised under such circumstances.

What would the President do? Turn on the printing presses? What else could he do? As a reminder, after this report was written, the redeemability of the dollar for gold was terminated intwo Oil Crises struck in andand massive Cold War expenditures characterized the 's. Ironically enough, we think that all this could be triggered by the anti-inflation campaign. It may prove all too successful. The money managers in Washington are aiming at a mild cooling down in business.

This would reduce spending and investment, and hopefully would slow down the rate of price escalation. We think that it may work for a while and to a degree. Unhappily it poses tremendous danger. During the last several years of inflationary boom, debt has gone far too high. Government, individuals and especially businesses have borrowed and spent without limit.

In an inflationary period, this makes sense. At the same time liquidity is at an all-time low. The danger is that some of the especially vulnerable businesses will get into deep trouble and that the trouble will spread.

Inand the economy could stand a moderate recession without its escalating into something worse. In this may no longer be the case. The trend toward illiquidity and dangerously high debt has proceeded for twenty years, and other figures indicate that the breaking point is near.

It might come very soon, or not for many months or even a year or two. Who can tell just when some stray breeze will cause a rickety house of cards to collapse? Once a snowballing financial and economic deflation gets underway, it could develop with breathtaking speed.

Soon the government, instead of worrying about inflation, would be using desperation measures to halt the collapse, even if it had to run budgetary deficits of billion or more. In the short run, in a pragmatic sense, Washington would simply feel that it was tackling an overriding emergency, relieving hardship, etc.

In the long term, what it would be doing was to inflate up to the point where most of the huge debt burden was wiped out, and a fresh start could be made. Of course, this would be at the expense of millions of savers who would lose most of their capital. Hopefully the expropriation would be less drastic than it was in Germany. By the end of the 's, double-digit inflation had ravaged the American financial landscape.

This forecast by Scientific Market Analysis was not only accurate, it was prescient, and the conclusions drawn enduring. Only the very strict monetary policies of the Federal Reserve Bank during the 's under chairman Paul Volcker kept the nation from sliding into the hyperinflationary abyss, and those years became a period of relative calm.

The profligate fiscal policies of the United States government, however, continued unabated, and after the credit crisis ofthe Federal Reserve began openly and unapologetically monetizing the national debt through its quantitative easing program. Sincethe overall national debt has grown to enormous proportions and so has the Fed's balance sheet of monetized assets.

This represents a reliance on the Fed that is greater than ever before in history! Return to the Gold Classics Library Index Page. Contemporary gold and silver bullion coins Bullion-related historic gold coins U. Prefer e-mail to get started? USAGOLD has been a recipient of the Better Business Bureau's prestigious Gold Star Certificate every year it has been issued — sixteen straight years without a complaint.

Premiums have fallen to all-time lows. Call to reserve your order. The right portfolio mix at the right price. Silver Stackers Special World's Top Five Silver Bullion Coins SETS of 20, 60 or each Now available for immediate delivery. You're going to need more than a gold watch!

OPEN ACCESS FILE WHY GOLD, WHY NOW For those seeking a deeper understanding of gold's role in the modern investment portfolio. The China Syndrome The groundbreaking series on China's pivotal role in the gold market. BlackSwans YellowGold The standard reference on how gold performs during periods of deflation, chronic disinflation, runaway stagflation and hyperinflation Gold Chartography The case for gold ownership in ten charts you will never see on CNBC.

How would you invest money you didn't need for ten years? Keynes on the menace of printing money How the celebrated economist might have structured his investment portfolio today. Kosares, the author of these articles, has more than 40 years experience in the gold business. He has written numerous magazine and internet essays and is well-known for his ongoing commentary on the gold market and its economic, political and financial underpinnings.

Book Order Form US. Arial, Helvetica, sans-serif; font-size: BoxDenver, CO USA Prices Gold coin prices Silver coin prices Current special offers GOLD TODAY! Mobile Mobile hub Gold coin prices Silver coin prices Live spot prices. Services About us IRA rollover Small order desk Current special offers Past special offers U. Reference Reference library index Gold coin catalog Gold classics library Piles of gold image gallery Gold trading hours.

About us What separates us from the competition Client testimonials Better Business Bureau rating Better Business Bureau reviews Denver, Colorado Key staff How to choose a gold firm.

The Nightmare German Inflation A family's life savings could not purchase a cup of coffee. GOLD CLASSICS LIBRARY - OPINION Editor's note - The many parallels between Germany and present-day United States are cause for concern. In my view, this has occurred for two good reasons: The Years When the war broke out on July 31,the Reichsbank German Central Bank suspended redeemability of its notes in gold. Wholesale Price Index July 1. Printable Version RELATED LINKS. Free monthly newsletter sign-up.

How to choose a gold firm. Quick website guided tour. Few can match our golden credentials USAGOLD has been a recipient of the Better Business Bureau's prestigious Gold Star Certificate every year it has been issued — sixteen straight years without a complaint. Publication day e-mail alerts for future issues. Published by USAGOLD Michael J. OPEN ACCESS FILE WHY GOLD, WHY NOW For those seeking a deeper understanding of gold's role in the modern investment portfolio The China Syndrome The groundbreaking series on China's pivotal role in the gold market BlackSwans YellowGold The standard reference on how gold performs during periods of deflation, chronic disinflation, runaway stagflation and hyperinflation Gold Chartography The case for gold ownership in ten charts you will never see on CNBC How would you invest money you didn't need for ten years?