Fibonacci sequence day trading

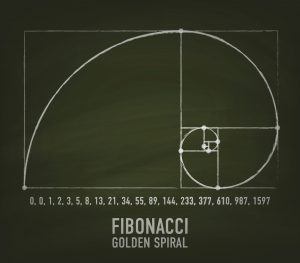

By Alan Farley I just finished reading The DaVinci Code on vacation. I wanted to get through it before the butchered two-hour Hollywood version comes out in May. My wife warned me that Fibonacci makes a cameo appearance in the book, so I wasn't surprised to see the progression of numbers so familiar to modern traders:.

Fibonacci trading strategies - advanced guide to Fibonacci trading

Leonardo of Pisa c. In most cases, they are used to predict how far a stock or futures contract will pull back after a rally or selloff before it bounces firmly in the other direction.

Of course, not everyone uses or believes in this esoteric methodology. Many traders are quite skeptical, dismissing this type of analysis as nothing more than market voodoo.

But that hasn't stopped me from using it religiously since the mids. I've applied all sorts of voodoo techniques to trading in the last 15 years.

How to Use Fibonacci Retracement Levels in Day Trading

These voyages to the dark side include Elliott Wave Theory, Gartley patterns and even phases of the moon. I'll try anything if it can make me a few bucks. In reality, voodoo trading can add a lot to your bottom line. Gann, Elliott and other cultists spent years studying the market's mystical side and how obscure ideas can tap hidden profits.

Magic numbers, astrological dates and prayer wheels have all been enlisted in the quest to get an edge in the market. Markets swing off common retracement levels as they move from support to resistance and back.

Taking The Magic Out Of Fibonacci Numbers

But these dynamics have become harder to trade in recent years. The popularity of Fibonacci analysis is the likely reason. Many smart players trade against key retracement levels because they know weaker hands will jump in at these prices.

For example, they'll sell at Fib support just because retail traders expect a bounce at that level. But Fibonacci applications still have tremendous value for swing traders.

The trick is to use an original approach. Never trade a retracement level in a vacuum. Instead, look for other forms of support or resistance to show up at the same price levels. NYSE - commentary - research - Cramer's Take shows how this cross-verification process can increase confidence in buying pullbacks.

The stock exploded out of a five-month base last week and is pulling back. You can also trade the Fibonacci whipsaw. Let other traders take the bait and get shaken out after price breaks through the key number. Use this crossover as your long-side entry signal. This trade works well because the markets usually punish only one side of the price action at a time. So the flushing out of weakhanded long positions when the market breaks common support often sets up an excellent "failure" trade once the contested level is remounted.

Delving deeper into retracement strategies can also help you avoid the crowd. Gartley described little-known Fibonacci relationships in his book Profits In The Stock Market.

This classic setup works just as well now as it did during the Great Depression. Fibonacci Extensions - Bullish Butterfly Pattern: You can also trade Fibonacci extensions instead of retracements. Followers of Gartley's work have devised an extension trade called the Butterfly Pattern.

The combination of all these waves and ratios can be confusing to newer students of the financial markets. But one of the joys in applying complex Fibonacci mathematics is its ability to confuse most public traders.

After all, the markets rarely reward the common plays of the majority. Cracking The Fibonacci Code By Alan Farley I just finished reading The DaVinci Code on vacation.

My wife warned me that Fibonacci makes a cameo appearance in the book, so I wasn't surprised to see the progression of numbers so familiar to modern traders: