Forex trading ppp

Purchasing power parity PPP is a theory concerning the long-term equilibrium exchange rates based on relative price levels of two countries. The concept is founded on the law of one price; the idea that in absence of transaction costs, identical goods will have the same price in different markets.

Trading Direct - Stock Trading with the Lowest Margin Rates

PPP theory then says, that price differences between countries should narrow over time by exchange rate movements or by different speeds of inflation which also has some implications on exchange rate movements. As it was already mentioned - different countries consume different baskets of goods and it is partially possible to asses the relative price level.

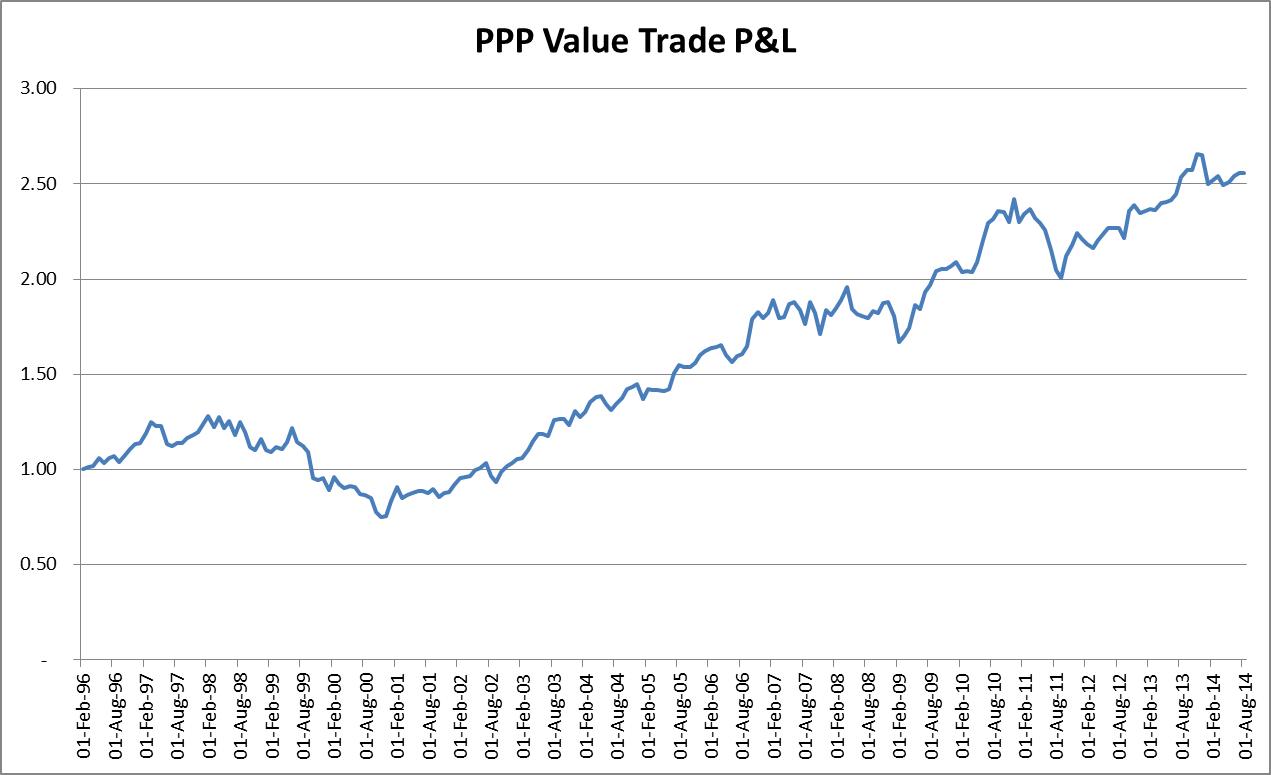

Price differences between countries narrow very slowly over time. A rebalanced portfolio which has the actual most undervalued and overvalued currencies helps to capture gains from exchange rate convergence to fair value. Create an investment universe consisting of several currencies Use the latest OECD Purchasing Power Parity figure to assess fair value of each currency versus USD in the month of publishing and then use monthly CPI changes and exchange rate changes to create fair PPP value for the month prior to the current month.

Go long 3 currencies which are the most undervalued lowest PPP fair value figure and go short 3 currencies which are the most overvalued highest PPP fair value figure.

Invest cash not used as margin on overnight rates. Rebalance quarterly or monthly. One of the strongest conclusions in academia is that fundamentals tend not to work for currencies in the short to medium term, yet they do long term.

International Diversification Benefits with Foreign Exchange Investment Styles http: Style-based investments and their role for portfolio allocation have been widely studied by researchers in stock markets. By contrast, there exists considerably less knowledge about the portfolio implications of style investing in foreign exchange markets.

Indeed, style-based investing in foreign exchange markets is nowadays very popular and arguably accounts for a considerable fraction in trading volumes in foreign exchange markets.

This study aims at providing a better understanding of the characteristics and behavior of stylebased foreign exchange investments in a portfolio context. We provide a comprehensive treatment of the most popular foreign exchange investment styles over the period from January to December We go beyond the well known carry trade strategy and investigate further foreign exchange investment styles, namely foreign exchange momentum strategies and foreign exchange value strategies.

We use traditional mean-variance spanning tests and recently proposed multivariate stochastic dominance tests to assess portfolio investment opportunities from foreign exchange investment styles. We nd statistically signi cant and economically meaningful improvements through style-based foreign exchange investments. The documented diversi cation bene ts broadly prevail after accounting for transaction costs due to rebalancing of the style-based portfolios, and also hold when portfolio allocation is assessed in an out-of-sample framework.

What is Market Beta in FX? In asset classes such as equities, the market beta is fairly clear. However, this question is more difficult to answer within FX, where there is no obvious beta.

To help answer the question, we discuss generic FX styles that can be used as a proxy for the returns of a typical FX investor.

Trading strategy based on PPP | Elite Trader

We also look at the properties of a portfolio of these generic styles. This FX styles portfolio has an information ratio of 0.

Big Mac PPP Definition | Forex Glossary by yyizibily.web.fc2.com

Later we replicate FX fund returns using a combination of these generic FX styles. We show that a combination of FX trend and carry, can be used as a beta for the FX market. Later, we examine the relationship between bank indices and these generic FX styles. We find that there is a significant correlation in most instances, with some exceptions.

What Is Purchasing Power Parity? (PPP) | Investopedia

Out-of-Sample Evidence on the Returns to Currency Trading https: This era of active currency speculation constitutes a natural out-of-sample test of the performance of carry, momentum and value strategies well documented in the modern era.

We find that the positive carry and momentum returns in currencies over the last thirty years are also present in this earlier period. In contrast, the returns to a simple value strategy are negative. In addition, we benchmark the rules-based carry and momentum strategies against the discretionary strategy of an informed currency trader: The fact that the strategies outperformed a superior trader such as Keynes underscores the outsized nature of their returns.

Our findings are robust to controlling for transaction costs and, similar to today, are in part explained by the limits to arbitrage experienced by contemporary currency traders.

Menkhoff, Sarno, Schmeling, Schrimpf: We show that measures of currency valuation derived from real exchange rates contain significant predictive content for FX excess returns and spot exchange rate changes in the cross section of currencies.

Most of the predictability stems from persistent cross-country differences in macroeconomic fundamentals.

This suggests that currency value mostly captures risk premia which vary across countries but are fairly static over time. Moreover, our results do not support the standard notion that trading on simple measures of currency value is profitable because spot exchange rates are reverting back to fundamental values. When decomposing real exchange rates into underlying macroeconomic drivers, however, we find that refined valuation measures relate more closely to "currency value" in the original sense in that they predict both excess returns as well as a reversal of exchange rates.

A New Look at Currency Investing http: The authors of this book examine the rationale for investing in currency.

They highlight several features of currency returns that make currency an attractive asset class for institutional investors. Using style factors to model currency returns provides a natural way to decompose returns into alpha and beta components.

They find that several established currency trading strategies variants of carry, trend-following, and value strategies produce consistent returns that can be proxied as style or risk factors and have the nature of beta returns. Then, using two datasets of returns of actual currency hedge funds, they find that some currency managers produce true alpha. Log in Sign up. Notes to Confidence in anomaly's validity.