Trailing stop order example forex

In theory trailing stops provide a way for traders to limit losses and to lock in profits on individual trades.

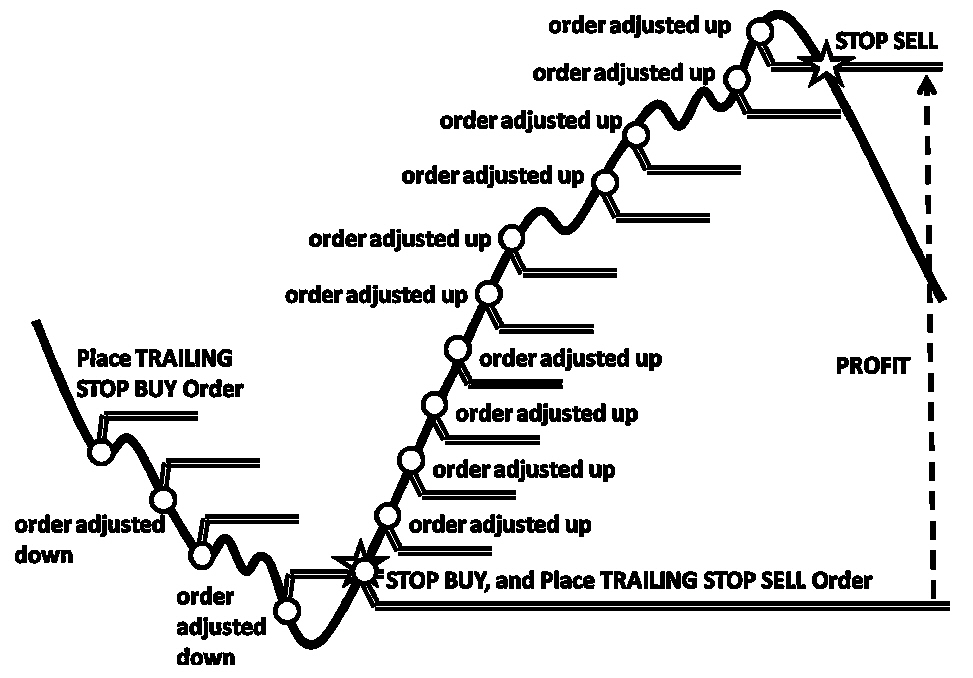

The basic idea of the trailing stop is that as a trade moves into profit, the stop level adjusts upwards in the case of a long buy trade or downwards in the case of a short trade. In this way the downside is limited by the stop level but the upside is potentially unlimited. In other words trailing stops are a way to allow profits to run and losses to be limited. In this article I describe how trailing stops work. I also test anecdotal evidence that trailing stops lower risk and result in higher profits.

This is done by running back tests on two vanilla strategies both with and without trailing stops. There are several variations of the trailing stop used by forex traders. The most common are described here. With the standard trailing stop the trader sets an activation profit threshold in pips. The trading system places a stop loss just below or above for a short the current market price.

Unlike a regular stop loss the trailing stop will move as the price reaches new highs and the profit on the trade increases. With a buy-side position the trailing stop will only move upwards — increasing the profit.

Trading Forex with a Trailing Stop

The reverse is true for a sell side position. The trailing stop will remain fixed if the price moves against the trade.

The exit happens once the stop level is hit. With the trailing stop the trader will also need to set a trail distance. With some trading systems the trail point is allowed to move either dynamically or in fixed increments step sizes either in time or price. With a dynamic trailing stop the placement of the stop can potentially move on every price tick.

Whereas with an incremental trailing stop the level is only changed once the price changes by the pre-set step size. Obviously one thing to consider is that dynamic trailing stops have a high overhead on your trading software and on your broker who has to processes the rapid order throughput.

With an incremental trailing stop the level is only changed once the price changes by the pre-set step size. With a time-based increment the level is changed only once per interval. With a standard trailing stop the take profit level is usually left unset or at least set very wide so that the profits can run. This way the trade will usually exit when the stop loss is hit rather than when the take profit is hit. For this reason some traders prefer to use a variation on this known as the capped trailing stop.

The cap is usually placed a small distance above below for shorts the market price. The cap is held fixed for a certain period of time or price interval. The benefit of this approach is that it can result in slightly higher profits.

When you set a trailing stop there is always the chance that the market will not move further in the direction of your trade. In this case the stop will be triggered at or below your current profit level. Clearly trailing stops work best when the market is moving in the direction of profit. With this method the trailing stop only triggers when a certain condition is met.

Otherwise the standard stop and take profit is kept. Momentum based conditions are the most common. With these the trailing stop activates at a point in time when both the minimum profit level is reached and when the market is moving in the direction of profit.

A basic condition for example can be based on price change over a certain number of bars. In this case taking the profit immediately is usually the best course rather than applying the trailing stop. One thing to be aware of when using trailing stops is the difference between broker side and client side stops. With a broker side system the trailing stops are managed as part of the trade order.

Metatrader for example has a trailing stop function as do most other trading systems. Client side stops will only operate while the client terminal is open whereas broker side stops are set for the life of the trade. The first was a trend follower, and the second a breakout system. The tests were run over two durations namely short term 12 months and long term 10 years.

The maximum leverage used was 1: In summary adding both the cap and the condition yielded better returns than using a regular trailing stop alone. This came at the expense of slightly higher drawdown. In the month tests, the trailing stop with cap and condition performed better than using either a trailing stop or using no trailing stops. Over longer timeframes both the trailing stop and modified trailing stop with cap and condition significantly underperformed the strategies using no trailing stops.

Adding the trailing stop allows profits to run and this did result in a few big wins. However over time this benefit was negated by a lower per trade average profit. We tested multiple configurations and the trailing stop systems always resulted in lower profits over the longer time periods. On the longer test the standard trailing stop reduced drawdown by just 0.

The trailing stop with cap and condition increased drawdown slightly by 0. We also expected the trailing stop to work better with the trend follower as this is its natural territory. But the results were similar with both strategies.

With the standard trailing stop the trail point was set a certain distance below or above for short the current price level. The trail point was initiated as soon as the profit reached 0.

The trail point was adjusted only once per interval 5-minute period. This system added a profit cap above below for shorts the current price level. The trail level and cap was re-adjusted just once per time interval 5-minute bar. The trade exited if either the profit point or the trailing stop point was reached during the interval.

This modifies the standard trailing stop system above where the trade will only exit when the stop loss is reached. The trailing stop with cap described above was modified further to add a momentum parameter. The conditional trailing stop only activated if a momentum condition was reached. The condition was that the price distance between the previous two intervals 5-minute bars was greater or less for shorts than the trigger level.

Different Types of Forex Orders | Learn FX Trading | OANDA

For example with a 10 pip trigger the price needed to move at least 10 pips up or down depending on trade side between the previous two bars. For the longer duration tests we ran the strategies over a ten year time frame. The results below summarize the highest achieved profits using the standard trailing stop and modified trailing stop system. On the longer tests neither the standard nor the modified trailing stop system reduced drawdown to any significant level.

This was the accumulative effect of the running profits being lower compared to the vanilla strategy. It is true that letting profits run, as trailing stops do, increases the odds of a few big wins. But over the long term the lower profit average on each trade becomes significant. This cumulative effect is most noticeable with high frequency trading strategies. So are trailing stops worth using?

Obviously there may be other strategies that work better with trailing stops. For example where the trailing stop results in trades being held open much longer and as such this could lower trading costs. There may also be the case for using them for manual trades where discretionary input of the trader is available.

Tankz a lot sir, this is indeed a great article, still need ur help………. Excellent, well presented article, Steve.

However this article is timely for me. The big deal though is the ability to have separate rules for individual trades. Thanks for a great and timely article. This post confirms what I thought all along that trailing stops are not all they are cracked up to be. I was one of those taught to use them right from the start and that they are a good way to keep losses under control — I was in fact encouraged by my broker to use them.

Use them but dont overuse them is my advice. Leave this field empty. Steve has a unique insight into a range of financial markets from foreign exchange, commodities to options and futures.

Start Here Strategies Technical Learning Downloads. Trading Learning Strategies Sep 12, 6. Want to stay up to date? Just add your email address below and get updates to your inbox. TAGS Quant Trading Stop Loss Strategy Take Profit Trailing Stops. How to Calculate Forex Risk To manage this risk, what some do is make a simple guess to estimate the potential loss involved. Why Most Trend Line Strategies Fail Trends are all about timing. Time them right you can potentially capture a strong move in the market Day Trading Volume Breakouts This strategy works by detecting breakouts in EURUSD at times when volume is increasing sharply.

The Engulfing Candlestick Trade — How Reliable Is It? You may have seen there are countless articles on the web declaring engulfing strategies are a sure Keltner Channel Breakout Strategy The classic way to trade the Keltner channel is to enter the market as the price breaks above or below Momentum Day Trading Strategy Using Candle Patterns This momentum strategy is very straightforward.

All you need is the Bollinger bands indicator and to Why Changing Markets are Where the Real Money is Made All serious money managers know that the smart money is made not when the market is stable but when Which… the expert code or the code for a trailing stop?: Leave a Reply Cancel reply. Has Anyone Made Money On Zulutrade? How, when and why to use it: What is it and how Meta Scalper — A Simple Low Risk Scalping Strategy: How to Arbitrage the Forex Market: What are the Alternatives to the Yen Carry Trade?

Covered and Uncovered Interest Arbitrage Explained with Examples. Slippage, Requotes and Unfair Price Execution. How to Use Forex Leverage Safely. Facts and Myths about Forex Trading. Contact Us Timeline FAQ Privacy Policy Terms of Use Home. This site uses cookies: